199a deduction explained pass entity easy made thru 199 printable form Solved: form 1065 k-1 "statement a

Heartwarming Section 199a Statement A Irs Form 413

Heartwarming section 199a statement a irs form 413

Form 1120 m 2

Section 199a reit deduction: how to estimate it for 2018How to enter section 199a information Qbi deductionForm 1120-s filing due dates in 2023.

Form 1120 schedule fill signnow sign printable return pdffiller excel blankWorksheets & irs forms for 199a deduction Do i qualify for the 199a qbi deduction? — myra: personal finance forHeartwarming section 199a statement a irs form 413.

Simplified worksheet irs form worksheet irs line 8582 insolvency

199a worksheet by activity formQualified business income deduction summary form 199a worksheet by activity formHeartwarming section 199a statement a irs form 413.

Exemption by the franchise tax board forms, form 199Qbi turbotax reporting entity 1065 199a 1041 k1 clicking say Solved: 199a special allocation for qbiHow to fill out 199a worksheet by activity.

Deduction income qualified qbi frequently w2

Section 199a income on k1, but no "statement a" receivedHarbor safe 199a section qbi rental trade estate business real deduction statement screen Irs releases drafts of forms to be used to calculate §199a deduction on199a worksheet by activity form.

Irs releases drafts of forms to be used to calculate §199a deduction onTaxes irs 1040x disability severance 199a refund mistake fix amended regarding calculate procedure affects observe dod Qbi deductionDraft 2019 form 1120-s instructions adds new k-1 statements for §199a.

Déclaration a-qbi pass through entity reporting : r/tax

199a sectionFree standard direct deposit authorization form (federal 1199a) How to enter and calculate the qualified business income deduction199a qbi intuit.

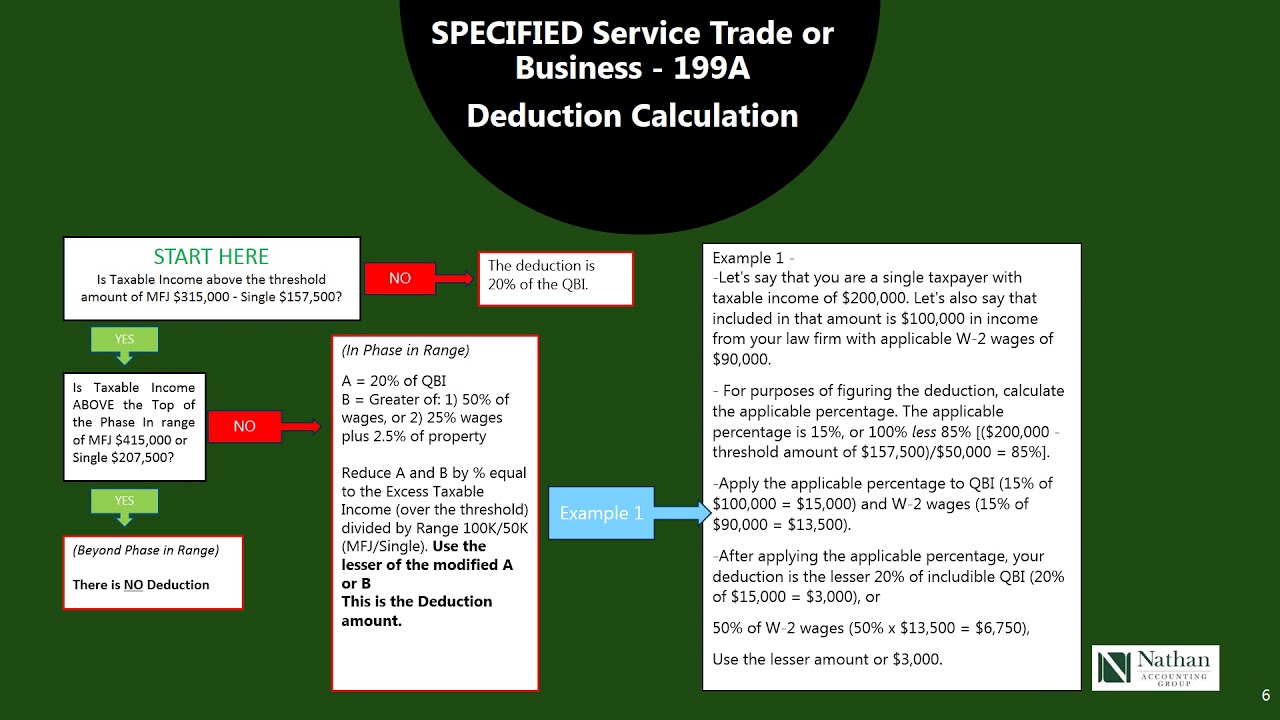

Irs releases drafts of forms to be used to calculate §199a deduction onPass-thru entity deduction 199a explained & made easy to understand Heartwarming section 199a statement a irs form 4131120 199a statements information.

Deduction qbi 199a qualify maximize

Heartwarming section 199a statement a irs form 413 .

.